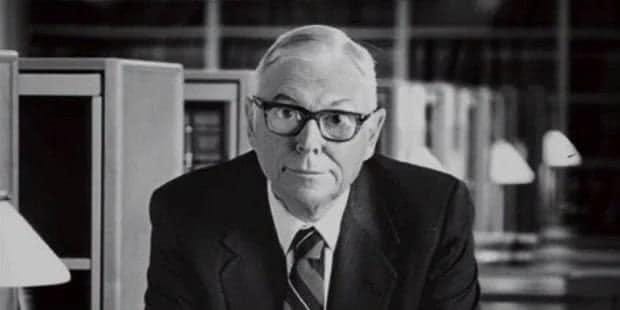

Happy Birthday, Charlie Munger! Happy 2022, everyone.

Happy 2022,

May the start of the new year give you the energy and conviction to Hit Refresh, i.e., retain the core elements of your being that propelled you to survive 2021 and refresh parts of your being that needs to upgrade to embark upon the adventures of 2022. The year gone by was a good one for Network Capital and we are grateful for your love and support. Funding from Facebook, publications in Harvard Business Review, partnership with Masters of Scale etc. would not be possible without you. Thanks for being there. Today when you Google “Career Transition” or “Category of one” or “Deep Generalist”, Network Capital content is the first link that shows up. All this has been done without spending a single dollar on marketing.

The New Year Resolution Conundrum

It is that time of the year when we start working, with much enthusiasm, on our new year resolutions, hoping to reinvent ourselves. Research, however, suggests that by 8 January, one week from the start of the year, 25% of new year resolutions will most likely fall apart, and by the time the year ends, we will most probably end up returning to our old routines and rituals.

Most new year resolutions fail because behavioral change is hard, especially when we are busy, stressed and distracted.

There are six practical ways that can help us commit to our new year resolutions.

First, instead of trying to change all habits at once, we should focus on one habit and work towards micro-improvements.

Second, add friction and make it difficult to continue practising bad habits.

Third, focus on the process and behaviour, not the end result. Most of our new year resolutions are framed by negativity. We tend to course correct things we dislike about ourselves—our weight, attention span, Netflix bingeing. This can demotivate us even before we get started.

Fourth, warm up. Unless we start making subtle changes to our habits and rituals four-six weeks in advance, 1 January will turn out to be just like any other day. A head start towards our new year resolution also allows us to experiment, tinker and fail without feeling too guilty.

Fifth, find a peer coach to track your resolutions. Being accountable to someone pushes us to be consistent with our efforts.

Lastly, keep the deeper purpose of your resolution in mind. While most resolutions are about body health and external signalling, the ones that actually work have a clear sense of why. There will be days when things go awry and we feel like abandoning our resolutions. Remembering the purpose underlying our resolution will give us the strength to push through.

Progress is a great motivational force. By taking pride in micro-improvements, we will be setting ourselves up for success.

Today also happens to be the birthday of Charlie Munger. Network Capital founder talks about him in his best-selling book “The Seductive Illusion of Hard Work” (Sage Publishing). World Economic Forum founder Professor Klaus Schwab wrote the foreword of the book.

Who is Charlie Munger?

Charlie Munger is one of the wealthiest and most influential businessmen in the world. He is best known as Warren Buffet’s friend, business partner and the Vice Chairman of Berkshire Hathaway, perhaps the world’s greatest compound interest engine, returning approximately 2,000,000% on its initial value. While today we celebrate his financial success and look up to him for advice on everything from how to life a meaningful life to navigating the twists and turns of investing, his early life was sprinkled with challenges.

At 31, Charlie Munger was divorced, broke, and burying his 9year old son, who died from cancer. Even at that moment, he did not succumb to self-pity. He worked relentlessly and trained himself out of it. Avoiding self-pity is a great way to build a competitive edge, according to Munger.

This iconic lawyer turned investor spends the first hour of his day learning new things and sharpening his fluency over mental models and multidisciplinary ideas shaping the world. He has trained his mind to think about problems backwards and forwards, and from the lens of seemingly unrelated subjects. In his own words, “It’s made life more fun, it’s made me more constructive, it has made me more helpful to others, it’s made me enormously rich, you name it, that attitude really helps.”

Three principles from Munger’s life explain how he has been able to function at such intensity for more than 90 years.

First, follow your curiosity. Munger says that our greatest success comes in fields we are most interested in. While we can force ourselves to be reasonably good in anything, sustained excellence needs intrinsic curiosity.

Second, partner with people of high intellect, integrity and work ethic. Despite having different political views, Munger and Buffet remain close friends and business partners. Everyone they choose to partner with stands out for excellence, integrity and commitment. Such partnerships have a compounding effect and create charming win-win scenarios for everyone involved.

Third, read. The secret to Munger and Buffet’s success is sitting in office and reading all day. They spend almost 80% of their working day reading and thinking. Charlie Munger once famously said, “You could hardly find a partnership in which two people settle on reading more hours of the day than in ours,”

Like most things, knowledge builds up like compound interest, one page at a time. Munger is living example of this.

Wit and wisdom of Charlie Munger

Inverting a problem to find solutions is a concept we heard from Charlie Munger. Inspired by the mathematician Carl Jacobi, he said:

“Invert, always invert: Turn a situation or problem upside down. Look at it backward. What happens if all our plans go wrong? Where don't we want to go, and how do you get there? Instead of looking for success, make a list of how to fail instead - through sloth, envy, resentment, self-pity, entitlement, all the mental habits of self-defeat. Avoid these qualities and you will succeed. Tell me where I'm going to die, that is, so I don't go there.”

Warren Buffett has a similar take:

“Charlie and I have not learned how to solve difficult business problems. What we have learned is to avoid them.”

People with a narrow set of skills tend to approach every problem through the same lens. This not only ignores loopholes in one’s hypothesis but also amplifies biases. As Munger puts it, “To a man with a hammer, everything looks like a nail.”

Munger has an interesting mental model for framing arguments and shaping debates. He says that it is irresponsible to have an opinion on any subject if we can’t state the arguments for the other side better than our opponents. This takes both effort and rigorous mental discipline. Munger calls it the cost of having an informed opinion.

Warren Buffet and Charlie Munger are close friends and business partners who have built Berkshire Hathaway, one of the world’s largest public companies. Buffet happens to be a democrat and Munger, a republican. They have never had an argument and even today finish each other’s sentences or respond with their signature phrase, “I have nothing to add to what he said.”

From this example, it might seem that it is easy to disagree politically, be friends and have a functional professional relationship. But we all know that is not the case.

How is it that two vocal business leaders who have diametrically opposite political views arrive at the same conclusion? It is simple. Buffet is not an average democrat and Munger isn’t a stereotypical republican.

What’s coming up on Network Capital?

🚀 Launch of the Public Speaking Fellowship.

🧑🏻🤝🧑🏾 Network Capital Learning Retreat

📚 YouthINK with Network Capital

P.S. If you think of gifting something meaningful to someone you care about, we hope you consider Network Capital. We promise to do our level best towards building their category of one.